The impact of COVID-19 on the global economy and the CRE industry makes 2020 the most particularly year in recent history. CRE companies need to operate digitally, close physical stores due to extensive lockdowns and prepare to reopen, while ensuring the health and safety of employees and occupants, and considering the financial status of tenants and end users.

We must understand how well-equipped CRE leaders weather the current economic situation, how they plan to recover in the next 12 months, and how they are prepared to remain competitive and flourish in the long term. To this end, Deloitte conducted a survey of 200 senior CRE managers in 10 countries/regions in 2020, including owners/operators, developers, brokers and investors. Overall, most interviewees believe that their companies are not prepared in some important areas, and that the industry continues to work hard to adjust its long-term strategy (Figure 1). Some key challenges:

1- Only one-third have the resources and skills needed to run a digital transformation business.

2- Less than 50% believe that the digital tenant experience is the core competence of their organization.

3- Only 41% stated that their company has stepped up its efforts to redefine business processes, job titles, and skill requirements to include the use of technology and tools.

For the company to grow in the long term, they need to overcome their own inertia to enter a rapid recovery. 2020 will be a landmark —2021 will even be a more important one. Important decisions and investments that leaders make now should be realized within the next 12 months. They should strive to achieve digitalization-optimizing businesses, operations, and customer models for the digital environment. A rapid digital transformation may be required to build operational resilience, maintain a sound financial situation, develop and retain talent, and create a favorable culture.

In this year’s 0utlook, we looked at the impact of COVID-19 on four functions: technology, operations, finance and talent, and emphasized how to overcome these huge challenges to open up a new world of opportunities for vision.

Technology: Digital transformation and tenant experience are business priorities

COVID-19 has accelerated the use of technology in the CRE industry. In just a few weeks, most CRE employees moved to remote work, property tours became virtual, most tenant communications were converted to online channels, and more technology was needed to manage daily operations. Some CRE companies have also increased the use of cloud-based collaboration and productivity tools to reduce internal technology costs and increase flexibility.

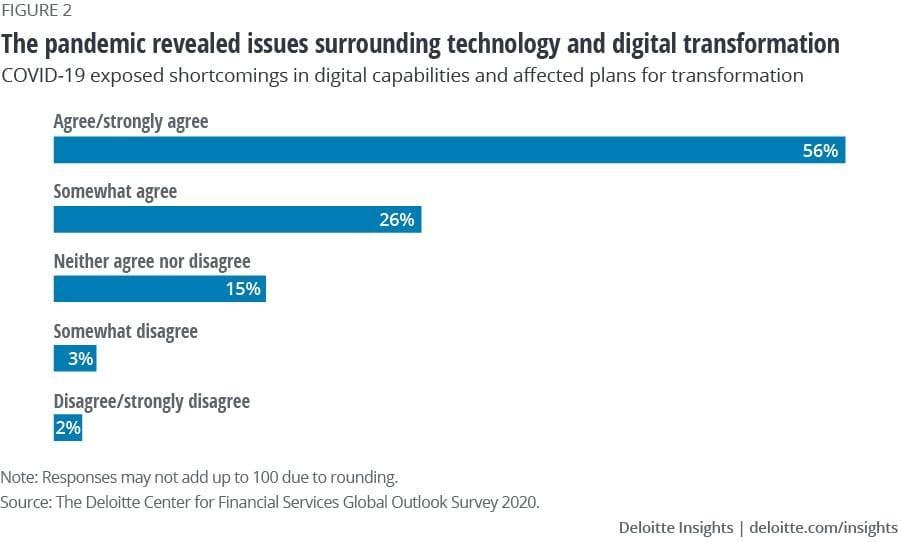

Although these measures may help improve the convenience of tenants and ensure business continuity, CRE companies are still experiencing difficulties in defining digital workflows and digitizing business processes. The majority of respondents (56%) believe that this pandemic has identified shortcomings in the company’s digital capabilities and affected their transformation plans (Figure 2). In addition, due to the increase in virtualization, data capture, and the use of cloud and digital tools for data sharing, the respondents’ attention to network security and data privacy is also growing.

Balancing tactical and strategic actions

The pandemic makes agility a top priority for CRE organizations. These goals require companies to focus on the digitization of business processes and tenant experience. Although many CRE companies have adopted a passive approach to digital conversion, a more structured plan (including the implementation of various technologies and data analysis) may produce more meaningful results. At the same time, in order to increase resilience, companies should redouble their investments in network security and data privacy.

Developing a digital strategy and roadmap

Many companies plan to develop a digital transformation, but only 40% of respondents said that their company has a clear digital transformation roadmap. North America reported that their companies are far ahead of their peers in Europe and Asia Pacific (Figure 3): 53% of respondents with a clear digital transformation roadmap believe that digital tenants have core competitiveness. In addition, compared with 32% of respondents in North America, 47% of respondents in Europe and 44% of respondents in Asia Pacific have begun to redefine business processes, job roles and skill requirements to embed technology.

CRE companies should assess their digital maturity by reviewing existing functions. This may include assessing the maturity of the technology used to manage operations, improving tenant experience, and training technical talent. Based on this assessment, CRE leaders should develop a digital strategy, focusing on technologies and plans that can bring strategic value. After that, the company should formulate an execution plan to carry out a digital transformation, and ensure that the transformation team has the right talents and governance structure to implement digital solutions. The governance structure should focus on effectively managing transformation plans and encouraging innovation.

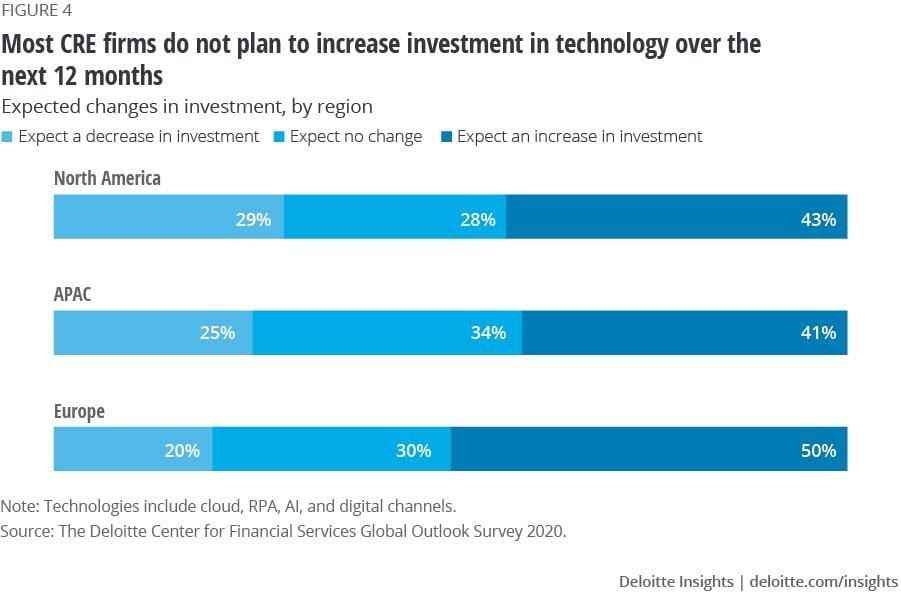

Companies should invest in technologies that can be the foundation of their digital transformation efforts. However, on average, only 45% of respondents plan to increase investment in cloud, robotic process automation, artificial intelligence, and digital channels in the next year.

Companies can improve the participation of tenants by optimizing real-time updates of related facilities and using mobile applications to develop community awareness. About half (48%) of the respondents stated that their company is using digital technologies such as interactive mobile applications to enhance communications with tenants or end users, and plans to increase investment in digital channels next year. Cloud technology can provide a lot of scalability, data storage and ubiquitous access, so it can become the basis for many new features.

In order to accelerate the implementation of the digital transformation roadmap, CRE companies should seek strategic partnerships with technology providers or proptechs. The REIT interviewees seem to admit this and are more willing to work with proptechs. On average, 58% of REIT respondents have increased their intention to cooperate with partners, compared with 45% of developers.

Leveraging tenant data and analytics

More than three-fifths of companies admit that they are capturing Internet of Things (IoT) sensor data. As more and more organizations and end users make data-supported decisions, sharing property-related data can help companies build trust and increase tenant/end user participation. For organizations, this may be a huge opportunity: Currently, 49% of respondents share data with tenants (Figure 5).

Now more than ever, CRE companies need to capture and analyze high-frequency data to create meaningful tenant experiences. This may include data on how tenants use different amenities and/or levels of participation and performance. Companies can analyze the participation and behavior of tenants to understand preferences and provide a more personalized experience. They can also use tenant data to predict lease renewals and design-appropriate strategies to retain tenants. The Asia-Pacific region seems to pay more attention to data analysis: 58% of respondents in the Asia-Pacific region expect their companies to increase investment in data analysis next year, while the proportions of European and North American respondents are 32% and 34% respectively.

Data analysis can also build investors’ confidence, who are increasingly seeking to use alternative data for insight generation and decision-making.

Are you interested in developing a digital transformation? Request a free demo at bookacorner.com!

Source: The Deloitte Center for Financial Services Global Outlook Survey 2020